The middle of March was certainly a bad time of year for Julius Caesar, but what about capital markets? After all, it was almost exactly one year ago when investors were looking directly into the abyss of another potential financial crisis with the sudden unraveling of Silicon Valley Bank, Signature Bank, and global banking giant Credit Suisse. Where do we stand today when it comes to major downside risk for investors?

Overdue. An important point is worth mentioning before going any further. The U.S. stock market is overdue for some sort of correction. It was less than five months ago that the S&P 500 was drifting to the downside. After a post banking crisis surge during the spring and summer of last year, the S&P 500 gave all of these gains back from August through October. But since bottoming just before Halloween, the S&P 500 has exploded to the upside. In the time since, U.S. stocks have skyrocketed more than +26% from trough to peak and has blasted to new all-time highs in the process.

Looking at the chart below, one might feel that Icarus/beeswax vibe. More on that in a minute. But at a minimum and purely from a technical analysis perspective, we should not be surprised at all to see a pullback in the S&P 500 from its recent high of 5189 to 4954 (down -4.5% to its 50-day moving average (blue line above)), 4571 (down -11.9% to its 200-day moving average (red line above)), or 4273 (down -17.7% to its 400-day moving average (pink line above last visited at the end of October 2023) and it would represent nothing more than a regression to the mean within the context of the market’s advance from its recent October 2022 bear market lows. Let’s repeat for emphasis, we could see the S&P 500 fall to the brink of what many consider to be technical bear market territory (down -20% from peak to trough), and the broader trend in the U.S. stock market would still be higher.

So just as remembering inevitable corrections as part of a longer term uptrend was important point to remember last summer when the market was falling by -11% peak to trough, it will be an important point to continue to remember when the next overdue correction finally arrives and hands start wringing across financial media (to the extremes, CNBC’s “Markets In Turmoil” specials are one of many particularly good contrarian indicators). But what at this point would rank as a likely catalyst to turn markets back to the downside?

Inflation. While it may inevitably be a known unknown or an unknown unknown that ultimately starts to rattle the nerves of the currently risk tolerant investor, we’ll focus on the latest headlines. On Tuesday, the Bureau of Labor Statistics (BLS) released its latest Consumer Price Index (CPI) readings on inflation for the month of February. And just like it did a month ago with the January readings, the latest CPI data came in hotter than expected. This has helped jack the 10-Year U.S. Treasury yield higher from below 4.10% before the report toward 4.30% afterwards.

Now coming into 2024, this Chief Market Strategist cited a renewed rise in inflation as the number one downside risk for capital markets in general and the U.S. stock market in particular this year. And this was after citing a renewed rise in inflation as the number one downside risk for the second half of 2023. In short, I take inflation risks and their implications for financial markets very seriously right now.

With this in mind, what are our key takeaways as we look beyond what we are hearing on the financial media into the actual numbers?

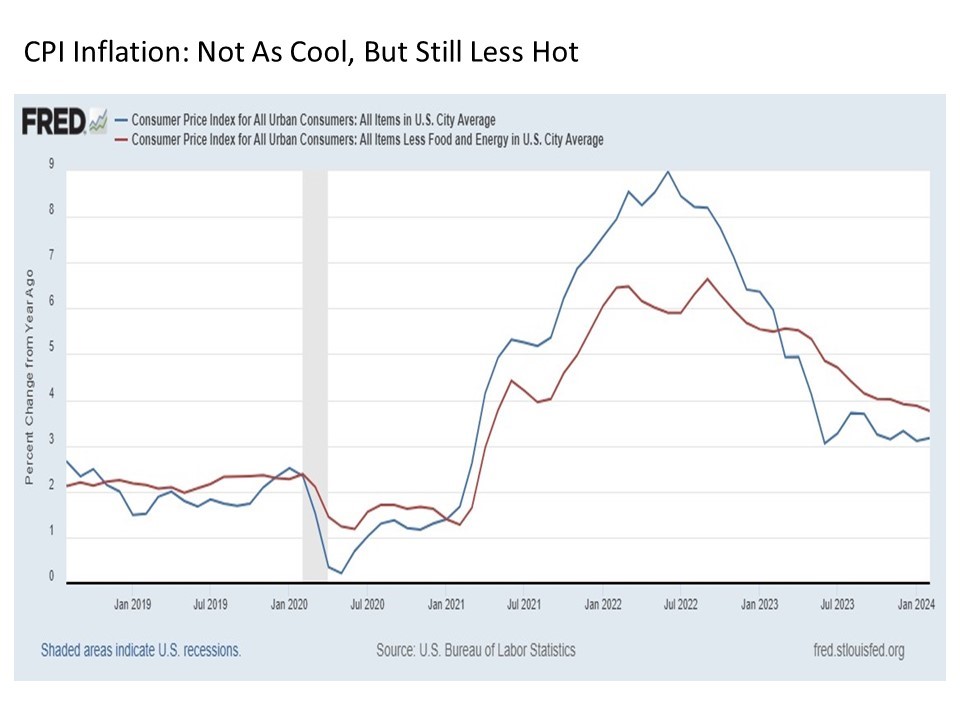

First, it is true that the CPI data did come in hotter than expected, but how much hotter really? So hot to register meaningful concerns about a renewed rise in inflation?

While headline CPI annual inflation rate did tick higher from 3.11% in January to 3.17% in February, it is still below the 3.32% reading from December. And while it is true that the headline annual inflation rate has flattened out since last June when it first hit 3.05%, it has been more of a leveling within a broader downtrend in headline annual inflation then any signs of a renewed rise. And while the monthly rise in the headline rate for February of 0.44% was certainly not the best look, it’s still below recent month-over-month pops north of 0.50% seen back in January 2023 and August 2023, yet the broader trend in annual headline inflation remained lower. In short, nothing yet to see here from a sustained downside risk for the markets perspective.

A look at the Core CPI annual inflation that excludes the more volatile food and energy components provides additional reassurance. Inflation data hotter than expected? Indeed. Nonetheless, Core CPI annual inflation still dropped another 11 basis points from 3.87% in January to a post inflation cycle low of 3.76% in February. When thinking in the context of a renewed rise in inflation, a smaller than expected continued drop in inflation remains a good thing, as the trend continues to move in the lower direction.

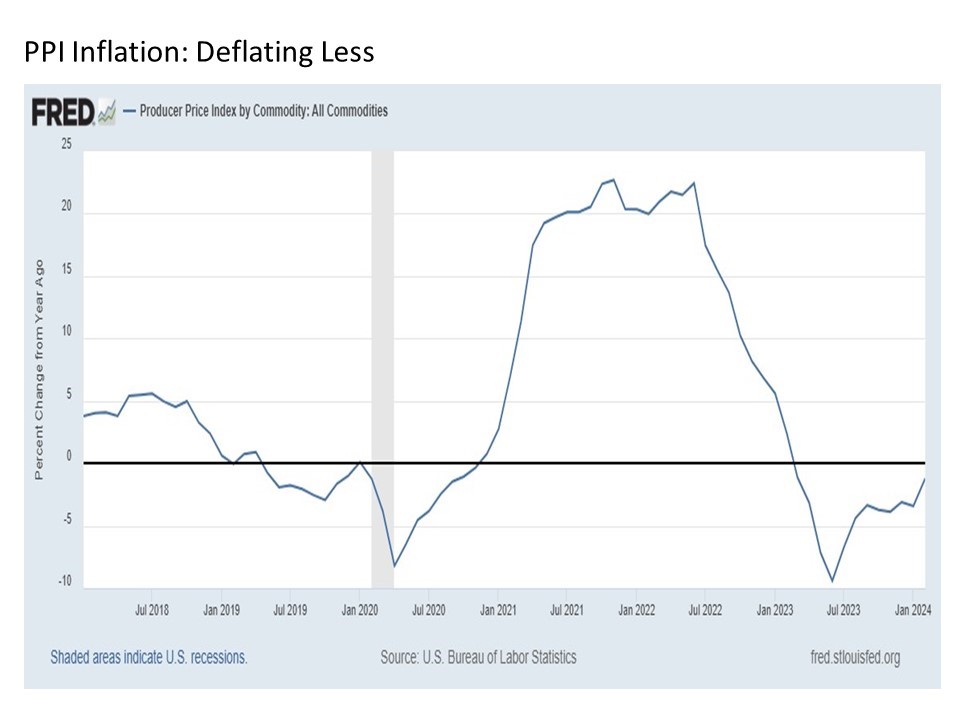

Roots of inflation. Let’s dig deeper. On Thursday, the BLS followed its Tuesday CPI release with Producer Price Index (PPI) readings for February.

Once again, the data came in hotter than expected. Nonetheless, producer prices are still deflating from where they were this time last year, continuing a trend that has been in place for more than a year now. So while we as consumers are still seeing prices rise, albeit at a lower rate, producers have been seeing prices fall in aggregate for more than a year now. Not only is this not supportive of a renewed rise in inflation, it has the aroma of wider profit margins for corporations that are selling the products they are producing to consumers. More on this point in a moment too.

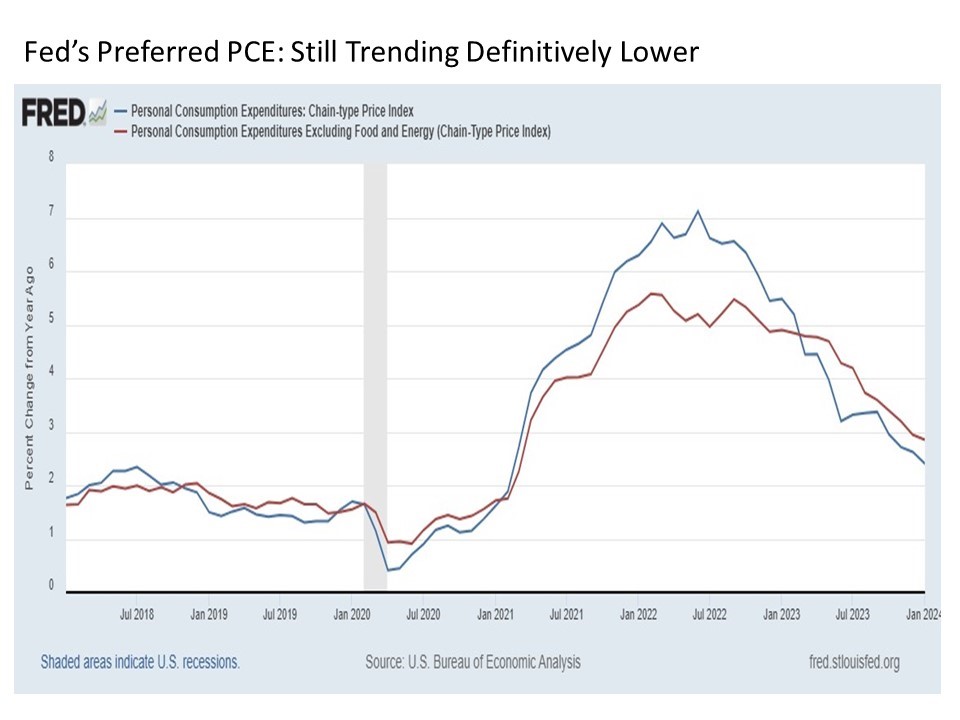

Inflation Part the one that actually matters. Let’s think differently. While the latest CPI inflation data may have been a bummer for those investors banking on a wave of interest rate cuts this year from the U.S. Federal Reserve, it is important to continue to remember that the CPI is not the bogey that the Fed’s watching anyway. Instead, it’s the Personal Consumption Expenditures (PCE) Price Index, and this reading continues to steadily and more definitively fall on both a headline and core basis. While I get the idea that the CPI that comes out in the middle of the month is a good reading when trying to gauge the PCE that comes out at the end of the month, the news remains more constructive for the rate cut hoping investors among us.

As a result, mark your calendars for March 29 when we get the latest PCE inflation readings for February from the Bureau of Economic Analysis for added confirmation that the broader inflation trend remains lower and not higher even if the monthly release comes in hotter (or maybe less cooler would be more appropriate) than expected. Current forecasts from the Cleveland Fed Inflation Nowcast have the headline PCE inflation rate ticking marginally higher from 2.40% in January to 2.45% in February and 2.54% in March (it was at 2.62% in December so the broader trend remains lower), while the more important Core PCE inflation rate is projected to drop further from 2.85% in January to 2.78% in February and 2.67% in March, continuing the steady decline further below 3%.

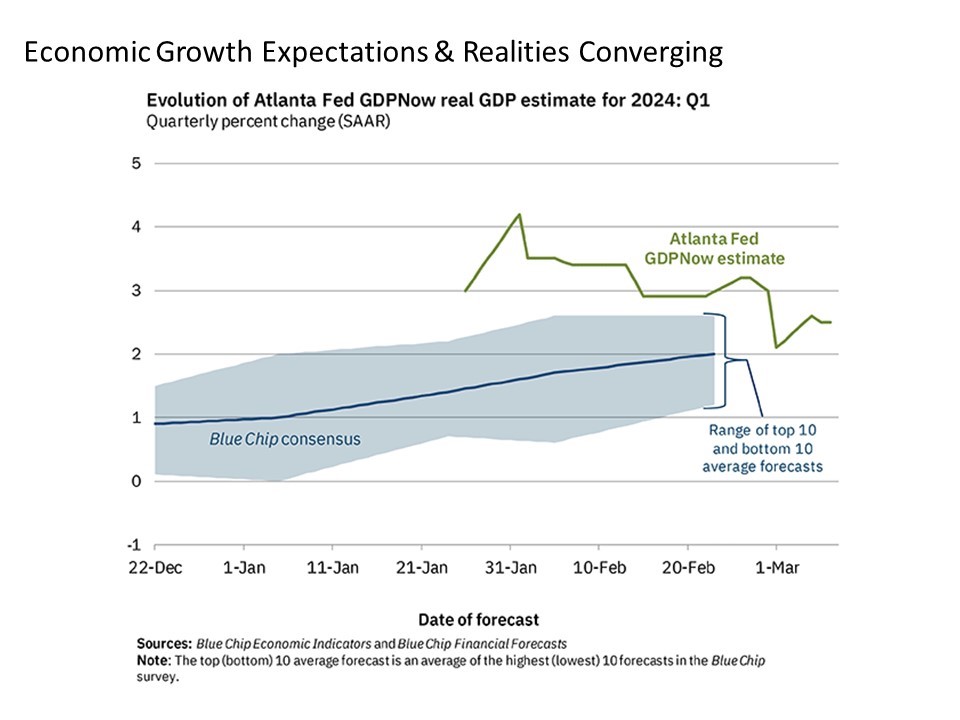

Back to the good old times. So despite continued discussion of hotter than expected inflation data supported by the latest readings, the reality remains that inflationary pressures continue to cool. And this steady and continued cooling of pricing pressures is occurring at the same time that the U.S. economy continues to hum along.

For example, while the latest readings on projected economic growth for 2024 Q1 according to the Atlanta Fed GDPNow have ticked back into the 2% to 3% range, it’s still positive real GDP growth in the 2% to 3% range, which is rock solid growth. If anything, it has been consensus expectations about economic growth that has been steadily rising to catching up to the underlying data reality. In short, perhaps the current market Icarus has more than just beeswax supporting the wings flying to the upside this year.

Moreover, the corporate earnings that are the fundamental mother’s milk for higher stock prices continue to move definitively in the right direction. For the latest 2023 Q4 earnings season that is largely drawn to a close, GAAP earnings rose at an impressive 12% annual rate. And while projected quarterly earnings over the next year were revised marginally lower versus the start of the year, these downward revisions at less than -2% were mild versus the -2% to -4% downward revisions we typically see over the course of an earnings season. More importantly, current forecasts are still signaling annual corporate GAAP earnings growth continuing in the 10% to 13% range through the remainder of the year. And when producer prices are falling when consumer prices are rising at a slower rate, this is the stuff of the steadily widening profit margins we continue to see from companies in sectors like information technology, communication services, industrials and consumer discretionary.

Ides? What Ides? Steadily declining inflation pressures coupled with solid economic growth, rising corporate earnings, and widening corporate profits continue to be the strong fundamental foundation in support of the higher stock prices that we continue to see this year. While the 26.5 times GAAP earnings valuation (3.77% earnings yield) on the S&P 500 certainly gives reason for pause, particularly in a market where the 10-Year U.S. Treasury yield trades at 4.29% (negative equity risk premium, anyone?), such valuations can remain supported indefinitely as long as the liquidity environment remains supportive. Recent years such as 2013, 2017, and 2021 have taught us as much.

So even if expectations for U.S. Federal Reserve rate cuts have arguably rightfully faded from seven quarter point rate cuts for 2024 heading into the year to only three quarter point cuts by the Ides of March, even if rate cut expectations go to zero in the months ahead, we can still see the markets go higher. This is because regardless of whether we get seven or three or zero rate cuts in 2024, as long as the conversation is almost exclusively about rate cuts (injecting more liquidity into an already humming market, currently a 99.1% probability according to the CME FedWatch Tool) and not rate hikes (withdrawing liquidity from a humming market, currently a 0% probability), then markets will continue to receive helpful additional support in sustaining their advance to the upside.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 554159-1