The U.S. stock market is flying once again this year. After posting an impressive +24% advance in 2023, a year when many prognosticators thought that the market would descend further into bear territory instead of skyrocketing, the S&P 500 Index is already up nearly +7% in 2024 so far. But a troubling characteristic continues to linger for the U.S. stock market, which is a notable shortness of breadth in the stocks that are participating in this upside strength. While this remains a downside risk that warrants ongoing attention in the months ahead, it also brings with it some important silver linings.

Breadth. So what exactly do we mean by stock market breadth? It deals with how stocks that are rising in value over time versus those that are declining. It also delves into how narrow or broad the stock participation in an overall market move to the upside. For example, if many stocks are moving higher along with the market, this is considered broad participation. Conversely, if a relatively small number of stocks are advancing at the pace of the market, this is viewed as narrow participation. And the latter of the two can be problematic for the market in working to build on upside gains.

Why is narrow market breadth a problem? Because it implies that further market gains are reliant on a smaller number of stocks that are carrying the weight of the overall market. If these stocks eventually start to falter, the subsequent downside in the market could be more pronounced as fewer stocks are remaining to offset the declines. This is why the so called Magnificent Seven stocks of 2023 were often viewed with some derision, for the concentrated strength in these very limited number of stocks obscured the overall weakness that existed across the rest of the stock market in 2023.

Breadth test. So where do we stand today on certain market breadth measures? Consider that in 2023, only 28% of stocks in the S&P 500 registered an annual return that was better than the +24% return of the overall Index. Not only was this the lowest percentage of stocks outperforming the broader market in at least a quarter century, but it was more than twenty percentage points below the long run average of 49%. In short, the market was remarkably concentrated last year.

The good news is that things have been broadening out so far in 2024. The S&P 500 is up nearly +7% so far this year, and 36% of stocks in the Index are beating the market to date. The bad news is that this reading is still double-digits below the long-term historical average. Less concentrated, but still highly concentrated.

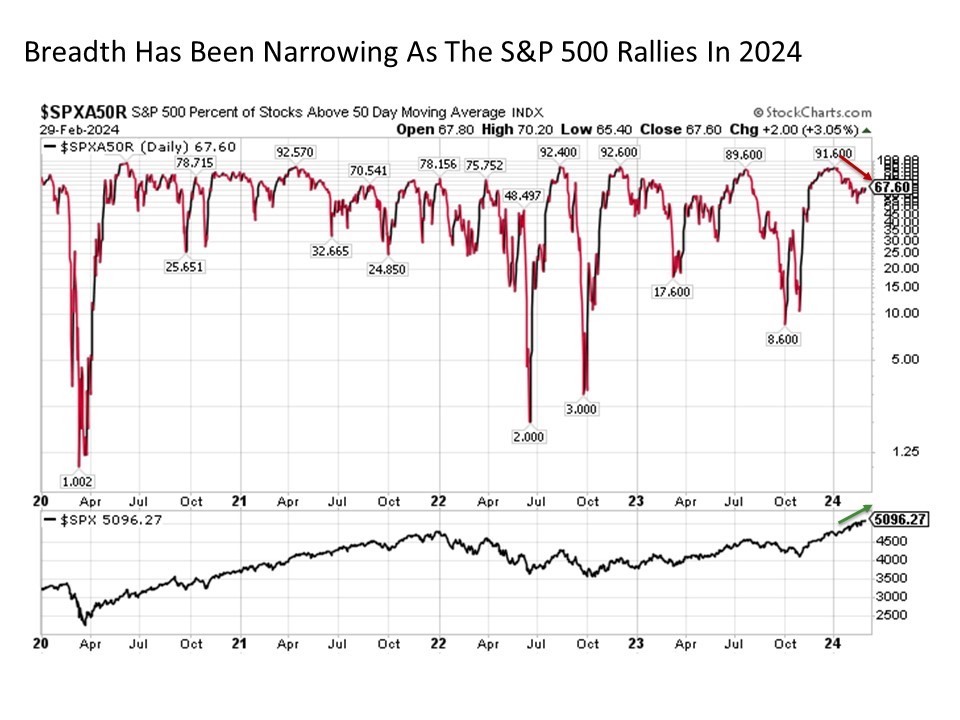

Another potentially troubling reading has been building beneath the market surface. A different way to measure market breadth is by considering the percentage of stocks that are trading above their 50-day moving average, with a higher percentage signaling broad participation and a lower percentage signaling narrow participation. This reading for the S&P 500 is shown in the chart below with the Index itself in the chart underneath.

We see at the start of 2024, more than 90% of stocks in the S&P 500 were trading above their respective 50-day moving averages. But two months later at the end of February and following a resounding start to the year for the headline benchmark, only 67% of stocks in the S&P are above their 50-day moving average. This means that 23% of stocks have tailed off enough to the downside to break below this key resistance level.

Enduring strength. In many instances, this narrowing of breadth might be cause for concern. But in the current market environment, it has more of the appearance of a broader stock market that is consolidating its late 2023 gains while still mustering up sufficient strength to continue to the upside in the meantime.

What leads to this potential conclusion? Beyond the fact that the U.S. economy remains stronger than expected with corporate earnings still on the rise as inflationary pressures continue to abate – this is a great combo to support higher stock prices – we have to look no further than 2021 to see how short-term periods of narrowing market breadth did not stand in the way of the broader market continuing to move to the upside. It wasn’t until breadth started to fade in a meaningful and sustained way toward the back part of the year that causes for concern started to build. With that being said, it is worth noting that a much broader 48% of stocks outperformed the S&P 500 in 2021, which is nearly spot on with the long-term historical average. As a result, it will be worthwhile in the weeks ahead to monitor whether the market can continue to improve on the modest Index outperformance improvement we have seen thus far in 2024 in assessing the sustainability of the stock market rally through the rest of the year.

Bottom line. Stock market breadth has improved so far in 2024 from year ago levels, but participation remains narrow. While the market can certainly continue to rise despite this concentrated performance, a further broadening of stock market participation would be a welcome development in supporting the continued advance of U.S. stocks further into the year ahead.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 548473-1