It’s back. After spending much of the year watching pricing pressures abate, investor concerns are rising about a renewed rise in inflation. It’s easy to see why – U.S. economic growth has been much more resilient than expected, the labor market remains tight, wage pressures are rising, and oil prices are spiking to the upside. And summing all investor fears, U.S. Treasury yields are spiking to the upside, providing proof for many that the renewed inflation threat is real. But are investors as concerned as recently spiking bond investors imply? Let’s take a closer look.

Price is truth. When it comes to capital markets, I have long been a firm believer in the notion that price is truth. One may be able to construct a compelling qualitative narrative about what should be in financial markets, but if actual market prices are not reflecting that reality, it is important to reevaluate the thesis.

With this principle in mind, let’s take a look at what market prices are telling us.

To begin, U.S. Treasury yields are signaling a potential problem. Since the very beginning of the inflation outbreak dating back to February 2021 through the present, the previous intraday high on the 10-Year U.S Treasury yield was 4.33% back in October 2022. Of course, this coincided with the bottom in the U.S. stock market. But after bottoming at 3.25% in April 2023, the 10-Year Treasury yield has been steadily on the rise including a spike this week toward the 4.50% level. Renewed concerns about inflation is driving this rise in yields, right? Perhaps, but let’s look further.

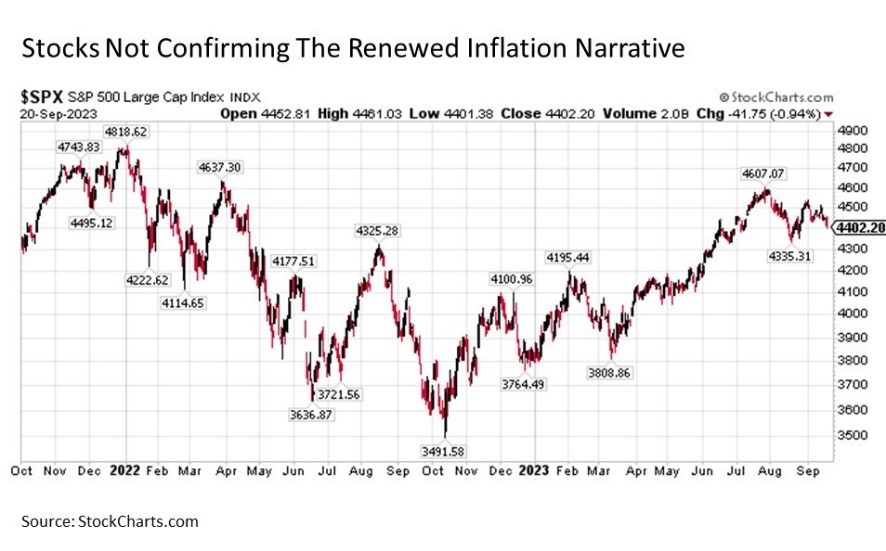

What about stocks? While bonds appear to be freaking out about inflation, U.S. stocks apparently have not gotten the memo. Remember when rising inflation was a concern back in late 2021 and early 2022? The headline benchmark S&P 500 started falling by more than -32% peak to trough through October 2022 led by big cap tech to the downside. Where are we today? Sure, U.S. stocks have been in a bit of slog since the start of August, but if anything it looks more like a market working to consolidate a robust summertime advance during a historically challenging time of year more than a any signs of jitters about inflation. In short, stocks are not confirming the message that bonds are sending.

Seeking a third party opinion, we take a look at gold. While gold is widely regarded as the classic inflation hedge, it’s true identity is actually a bit different. More broadly, gold is a hedge against economic and geopolitical instability. Can this include inflation? Yes, and this was certainly true in the 1970s, but the key is that inflation needs to be spiraling out of control as it was roughly fifty years ago. Otherwise, gold will fall when inflation is rising, as investors anticipate the U.S. Federal Reserve will intervene with tightening monetary policy to fight these pricing pressures, which drains liquidity from the marketplace and puts downward pressure on gold prices. This helps explain why gold struggled along with stocks and bonds back in 2022, as investors believed that the Fed would tighten as they did with a vengeance to defeat the inflation problem. What are we seeing today? While gold prices have been grinding since April, they are largely holding steady. In short, gold is also not signaling a burgeoning inflation resurgence either.

What about Jay? OK. But what about the U.S. Federal Reserve. They finished their latest FOMC meeting on Wednesday with a press conference that included Fed Chair Jay Powell pounding the table about “higher for longer” on interest rates including signals that one more quarter point interest rate hike may be in the offing before the end of the year. Cause for concern, right?

I recently spent quality time talking with a former Federal Reserve Bank President about monetary policy and what investors should take away from the Fed at any given point in time. One of the biggest things this individual emphasized to me was that investors should take the Fed at their word. FOMC members are not trying to trick the market with doublespeak and saying one thing but doing another. Put simply, the Fed intends to do what it says it’s going to do. And in the case of the Fed, they’ve been reiterating “higher for longer” for more than a year now. Perhaps investors are finally listening, but nothing really new came out of the Fed meeting yesterday that wasn’t already out there in one form or another from the Fed for months now. Even the upward revised economic growth outlook has been signaled by the Atlanta Fed GDPNow forecast for months now.

But what about the additional Fed rate hike before the end of the year? Back on August 28, the CME FedWatch Tool was signaling nearly a 60% probability for a quarter point rate hike from the Fed at its November meeting. This had faded to below 30% in the weeks since heading into the Fed press conference. And after the Fed meeting, probability for a Fed rate hike in November actually dropped even further to just 28%. It did marginally rise in December, but at 46% it is still well below the near 60% probability being priced in by the market less than a month ago.

So what is driving U.S. Treasury yields higher? Indeed, concerns about rising inflation may help explain why U.S. Treasury yields are rising. But the fact that concerns about a renewed rise in inflation are receiving little to virtually no support outside of the bond market suggests that perhaps other forces may be at work in driving yields higher.

A primary candidate to consider for why Treasury yields are rising is China. As has been widely documented, the China economy is struggling. The rebound in growth following their COVID lockdowns earlier this year has been muted at best. Perhaps more importantly, China is coping with a mounting wave of commercial real estate insolvencies and instability among their leading asset management firms that deal with trillions of dollars of securities. Historically, such periods of instability have resulted in liquidation pressures that have hit asset markets in the U.S. including Treasuries.

Taking a closer look at the Major Foreign Holders of Treasury Securities data from the U.S. Treasury, we see that China has reduced their holdings by more than -12%, or roughly $120 billion, over the past year through July 2023. And when looking at other countries where China Treasury ownership has historically transacted like Belgium, we see another roughly $40 billion coming off the table over the last year through July 2023. Given that China is still among the largest holders of Treasury securities in the world, the fact that they have been selling in size may be contributing to the upward pressure in Treasury yields, particularly in an environment where the U.S. Federal Reserve is now shrinking their balance sheet.

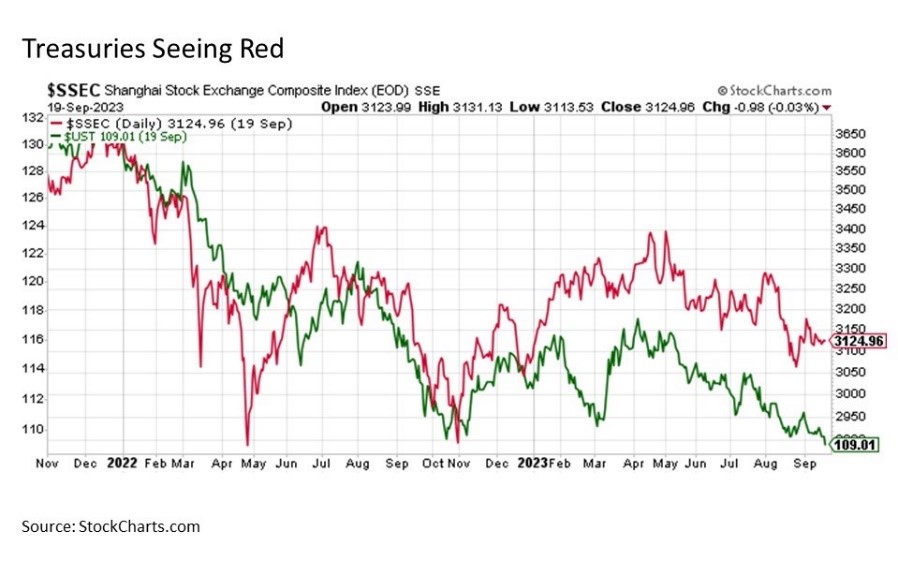

This notion is further evidenced when considering the performance of China stocks relative to U.S. Treasury note prices. For if China investors are truly liquidating, they are presumably selling their stocks along with their Treasury bonds. And when looking back over the last two years, we see a high correlation between the Shanghai Stock Exchange Composite and 10-Year U.S. Treasury note prices. This includes the period since April 2023 when U.S. Treasury yields bottomed and started to rise (and thus prices peaked and started to fall), as it coincides almost to the day to the China stock market also rolling over to the downside.

Bottom line. Talk about a renewed rise in inflation is likely to persist in the coming weeks. And while this risk is real and warrants close monitoring, the underlying market evidence suggests that the market is more sanguine on the inflation outlook than what the current headlines might suggest.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #481875-1