The time of year has come once again for families to gather around the table and give thanks for the good fortunes of life, friends, and health. And while money matters are typically set aside when passing the turkey, stuffing, and pumpkin pie, it is worth recognizing at this time of year the blessings that our economy and financial markets have bestowed upon us over the years.

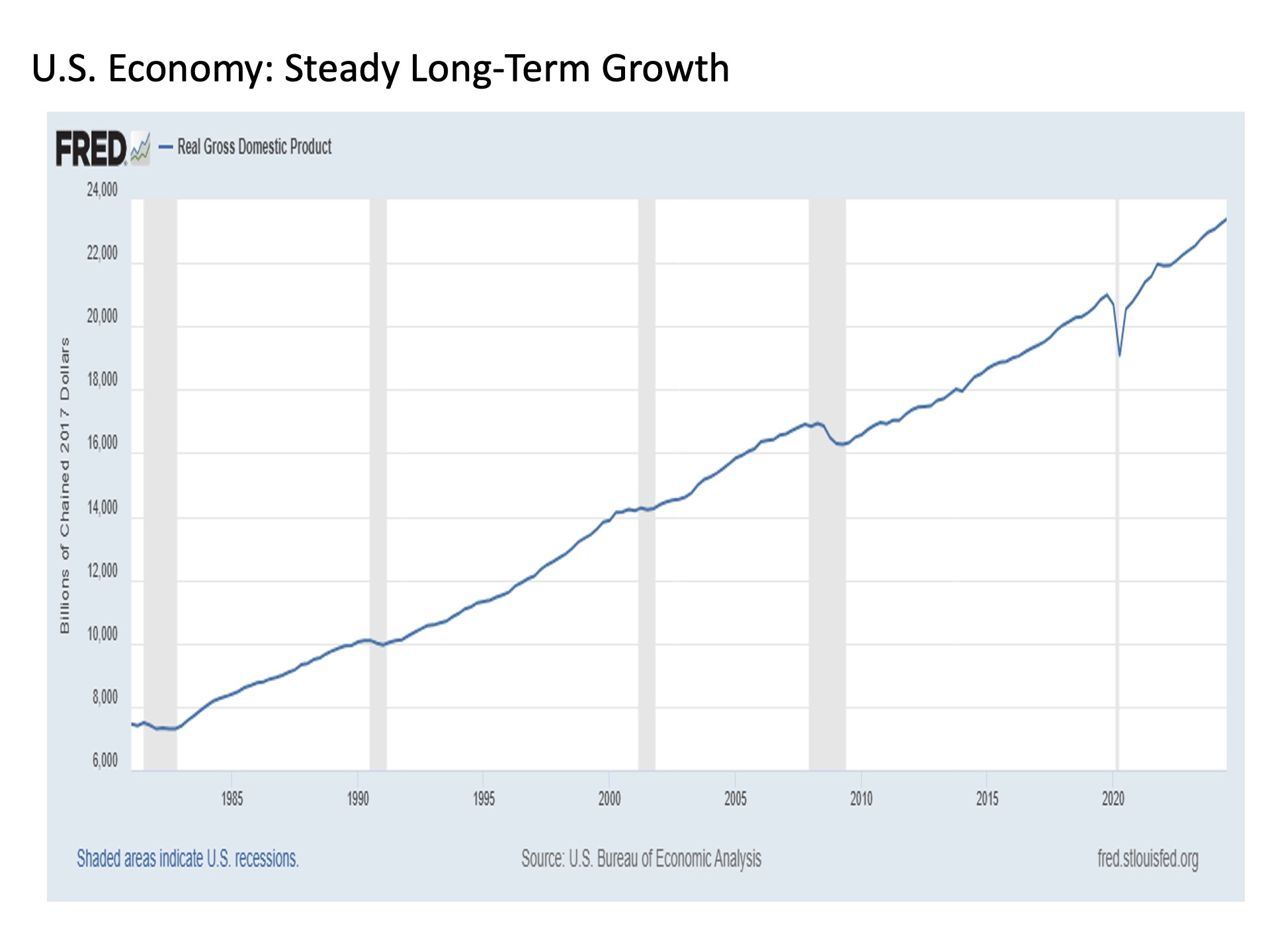

Economy. Consider first the U.S. economy. While we have endured mighty challenges in recent years such as the sharp and sudden COVID recession and the first major outbreak of high inflation in more than forty years, we have witnessed remarkable growth over the long-term. This includes an economy as measured by total output on an inflation adjusted basis that has more than tripled in size over the last four decades and increased by half since the turn of the millennium. In short, we as country are far more prosperous today than we ever have been.

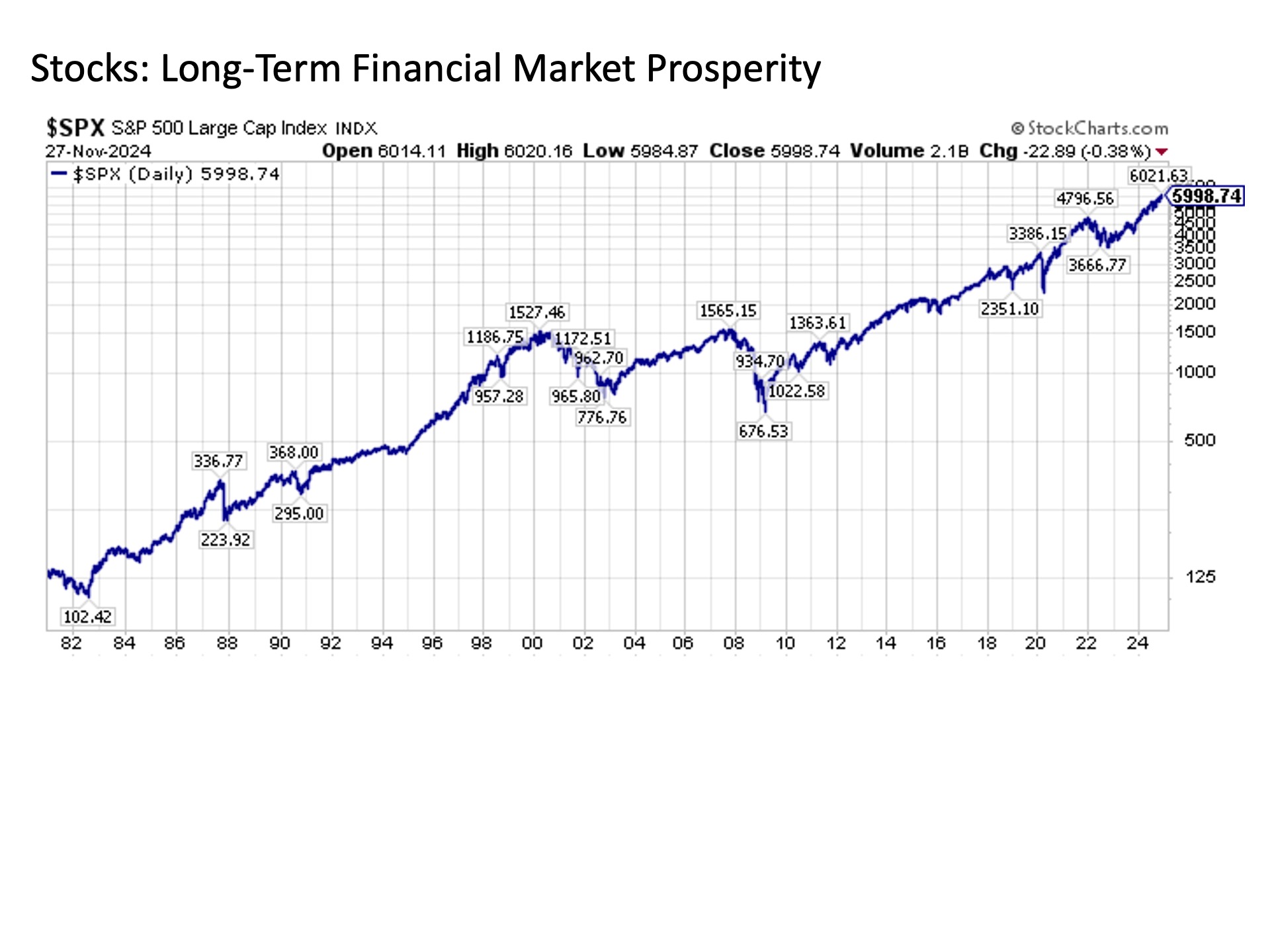

Indeed, we as stock investors have seen many major challenges over the years. This includes the sudden and shocking drop in stocks that accompanied the onset of the COVID crisis in 2020, when the S&P 500 dropped by -35% in just over a month from mid-February to mid-March that year. It also includes the dual market shocks of the early 2000s, when the bursting of the technology bubble and the financial crisis cut stock portfolios in half if not worse twice within the span of a single decade. And for those that go back far enough, it also includes the worst day in stock market history when the Dow Jones Industrial Average plunged by more than -22% in October 1987.

Despite these numerous short-term challenges that have periodically arisen along the way, the long-term growth of the U.S. stock market has been remarkable. An S&P 500 that was trading at around 100 four decades ago has increased by 60 times in the years since through today. This same headline stock market index that was trading at 667 just fifteen years ago and 2181 at the start of the current decade is now spending recent trading days rising above 6000. This is 60x in forty years, 9x in fifteen years, and nearly 3x in five years.

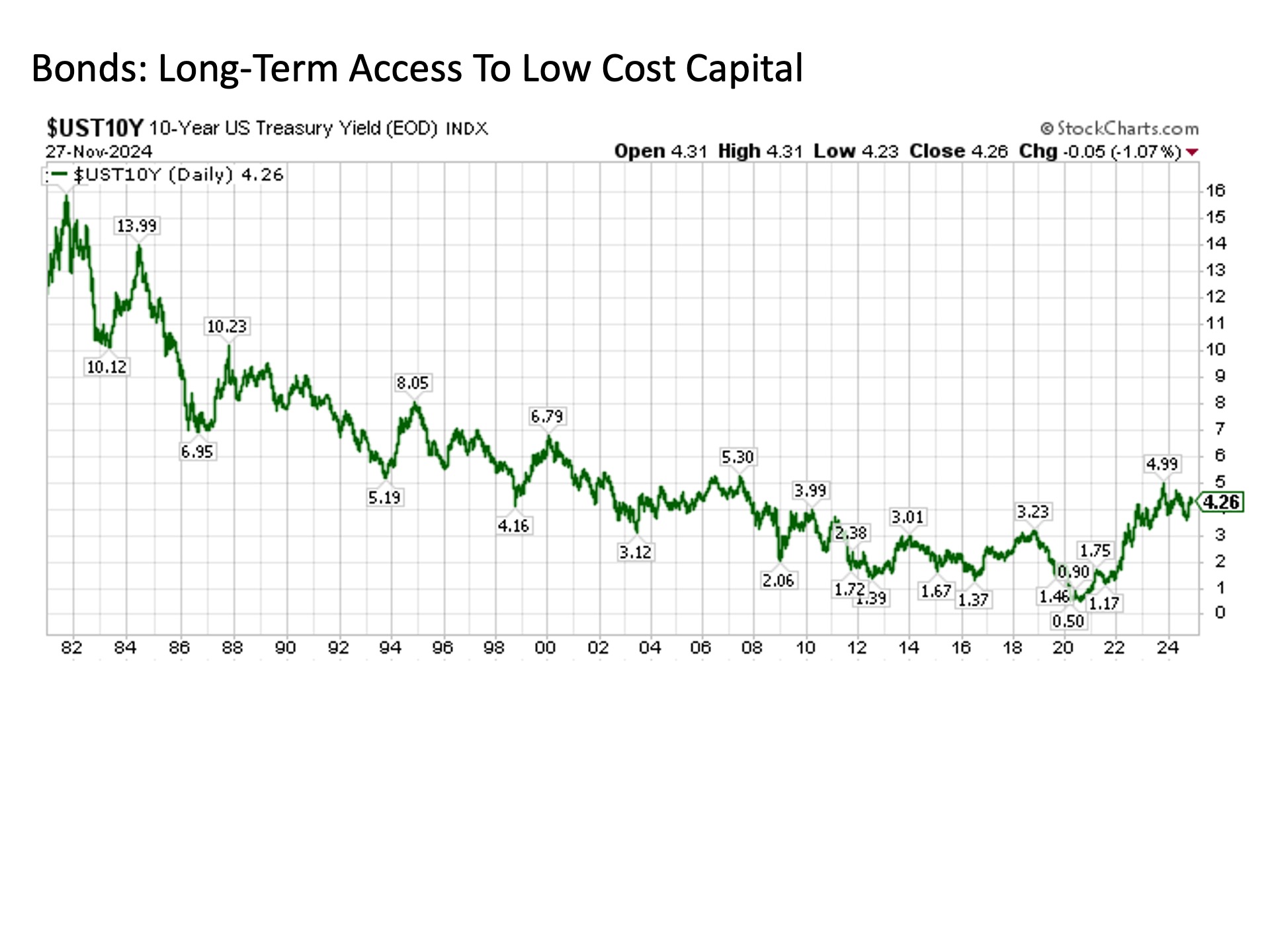

Bonds. Our reasons to give thanks also extend to the lending markets. Yes, the forty-year bull market in bonds appears to have finally come to an end in the aftermath of the COVID crisis (as bond yields fall as they consistently have in the chart below since the early 1980s, bond prices and the value of investor bond portfolios rise to complement the income that they are receiving from their bond investments), but the prosperous financial conditions that remain should still be appreciated. After all, a time existed within many of our lifetimes when obtaining a mortgage to buy a house or a loan to buy a car involved interest rates on borrowing that pushed as high as a loan sharkishy 20% or more. But accompanying the economic and financial market prosperity over the last many decades has been the ability to borrow capital for purchases and fixed investment at attractively low rates. This has enabled us to further enhance our prosperity by leveraging our capital in a manageable and predictable way.

Giving thanks for today, staying focused on the long-term. These are just a few of the reasons to give thanks for the prosperity that our economy and financial markets have provided many of us over the years. The long-term journey to today has not been without its numerous short-term challenges along the way, however. And as we travel into the future, new short-term challenges will arise, sometimes suddenly and shockingly along the way. But as history continues to teach us as investors, resist the urge to overreact to these periodic setbacks and instead remain dedicated to your long-term investment plan. This will help ensure that you are able to fully participate in whatever further long-term growth and prosperity the future may hold.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 665148