The first half of 2024 is just about officially in the books. It has been a rousing start to the year so far for the U.S. stock market. Following such strong performance in the first six months of the year, what can investors reasonably expect through the rest of 2024? The good news is that investors have a variety of reasons to remain constructive and optimistic. The outlook is not without risks, however.

Strong uptrend continues. As we look out into the second half horizon, it is worthwhile to assess where we stand with the markets today. Overall, the U.S. market remains a resoundingly positive picture. We have been in a stock bull market dating back to October 2022, and the uptrend in the benchmark S&P 500 remains well defined and firmly intact.

A few key points about the current market are worth highlighting. Let’s begin with the optimistic. If the current uptrend continues through the second half of the year, it would not be unreasonable for the S&P 500 to finish the year in the 5800 range. This would represent a more than +20% gain on the index for 2024. Taking this one step further, crossing the 6000 level on the S&P 500 along the way is not entirely out of the question depending on how much momentum and enthusiasm is behind the market as we move through the remaining months of the year.

Let’s now consider the realistic. The S&P 500 is currently overbought from a technical perspective. This includes a Relative Strength Index (RSI) reading that remains over 70. Historically, RSI readings north of 70 are followed by a market that needs to consolidate (move sideways) at a minimum and is overdue for some sort of pullback. And given that the S&P 500 is now trading at a frothy 4%, 13%, and 21% above its 50-day (blue line), 200-day (red line), and 400-day (pink line) moving averages, respectively, the U.S. stock market is now long overdue for some degree of mean reversion (movement back toward these trend lines). As a result, investors should not be surprised if we see a pullback anywhere in the range of -5% to -12% over a couple weeks if not a couple months between now and the end of the year. Any such correction should likely be viewed as a garden variety pullback that typically occur as part of a longer-term bull market similar to what we saw during the period from August to October last year. In short, a potential buying opportunity if anything.

Economic tailwinds. So why should investors remain optimistic if we see the outbreak of a stock correction through the second half of the year? Because the fundamental backdrop remains supportive of higher stock prices. Consider the current forecast for U.S. economic growth as measured by gross domestic product (GDP) from the Atlanta Fed GDPNow.

We see that current economic growth is projected to come in at +3% for 2024 Q2 based on the latest forecasts (green line above). This is not only a robust rate of economic expansion, but it continues to register in excess of consensus economists’ expectations (blue line above). So not only is the economy continuing to expand, but it is surprising to the upside in its strength. This is supportive of higher stock prices.

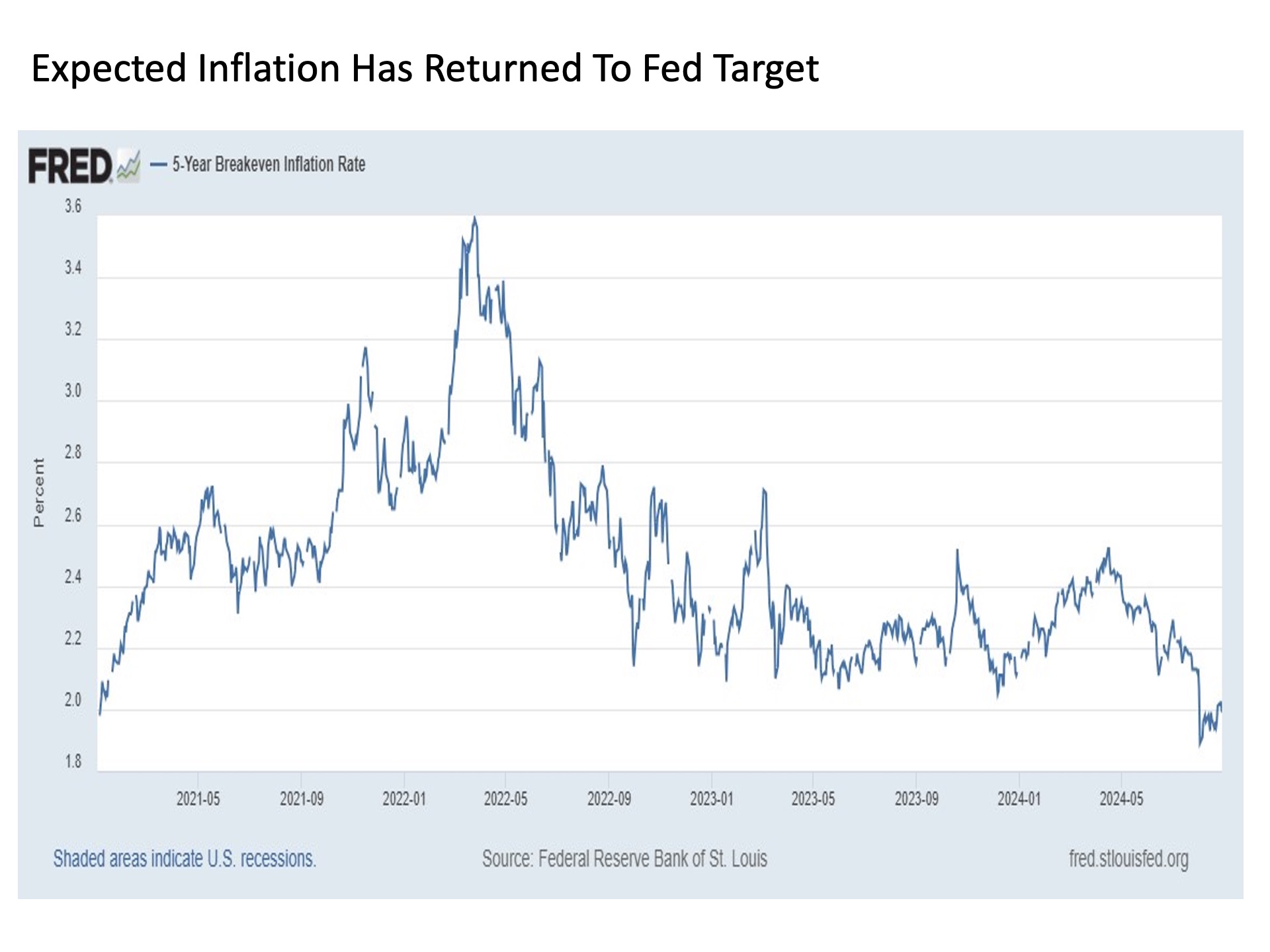

Adding to the positive economic fundamentals is the fact that inflation expectations remain firmly in check. Following the surge in inflation that was a primary driver of the 2022 stock bear market, 5-year average market inflation expectations are not only close to the U.S. Federal Reserve’s long-term target, they have faded in recent weeks to their lowest levels since the outbreak of COVID a few years ago.

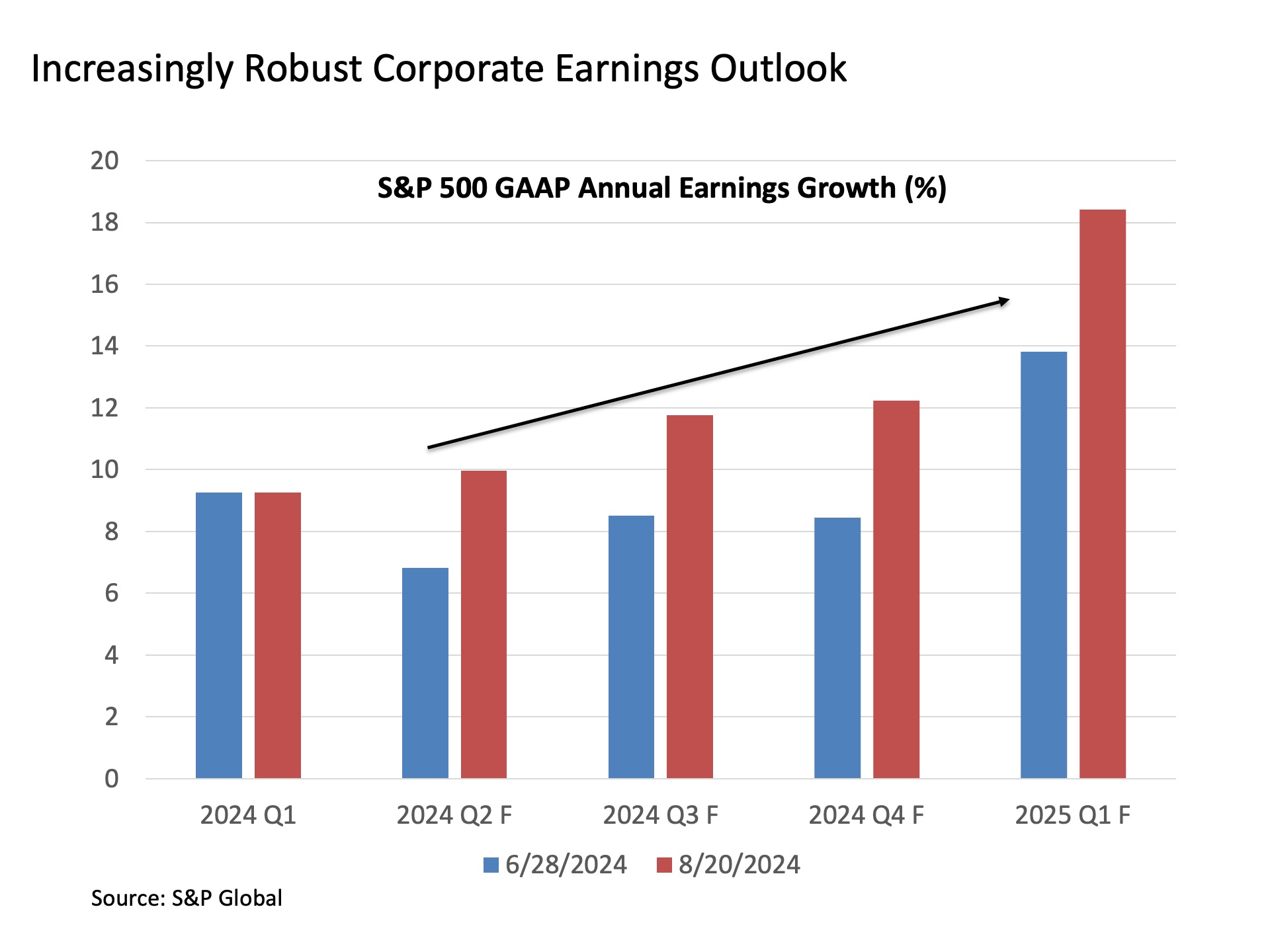

Corporate earnings. The positive economic backdrop is helping to support the financial performance of the companies that make up the U.S. stock market. This includes corporate earnings, which is a primary driver of stock performance and makes up the “E” in the P/E ratio that is widely used to value stock investments. Looking ahead through the remainder of 2024 and into 2025, S&P 500 corporate earnings are projected to rise more than +10%. This is a robust rate of projected profit growth, and if long-term market history is any guide, this strong profit growth is highly correlated with higher stock prices as shown in the chart below.

Downside risks. So the fundamental and technical backdrop for stocks is positive heading into the second half of the year, but what about the downside risks?

Inflation resurgence. It was true heading into the year, and it remains true today. The number one downside risk to the markets heading into the second half of the year is a renewed rise in inflation. Dating back to the peaks in headline and core inflation in the summer of 2022, the annual rate of inflation has steadily faded from nearly 9% and 7%, respectively, to approaching a more normal 3% today. But inflation readings have frequently come in hotter than expected so far in 2024, and if the blue and red lines in the chart below stop drifting lower and start pushing higher, this would be a decidedly negative sign for the stock market. Why? If the annual rate of inflation starts rising again, this means that the persistent investor anticipation for Fed interest rate cuts could suddenly shift to worries that the Fed may need to raise interest rates even further. And just as investors love monetary policy liquidity pouring into the markets (cutting interest rates), they recoil when monetary policy liquidity is being drained out of the markets (raising interest rates).

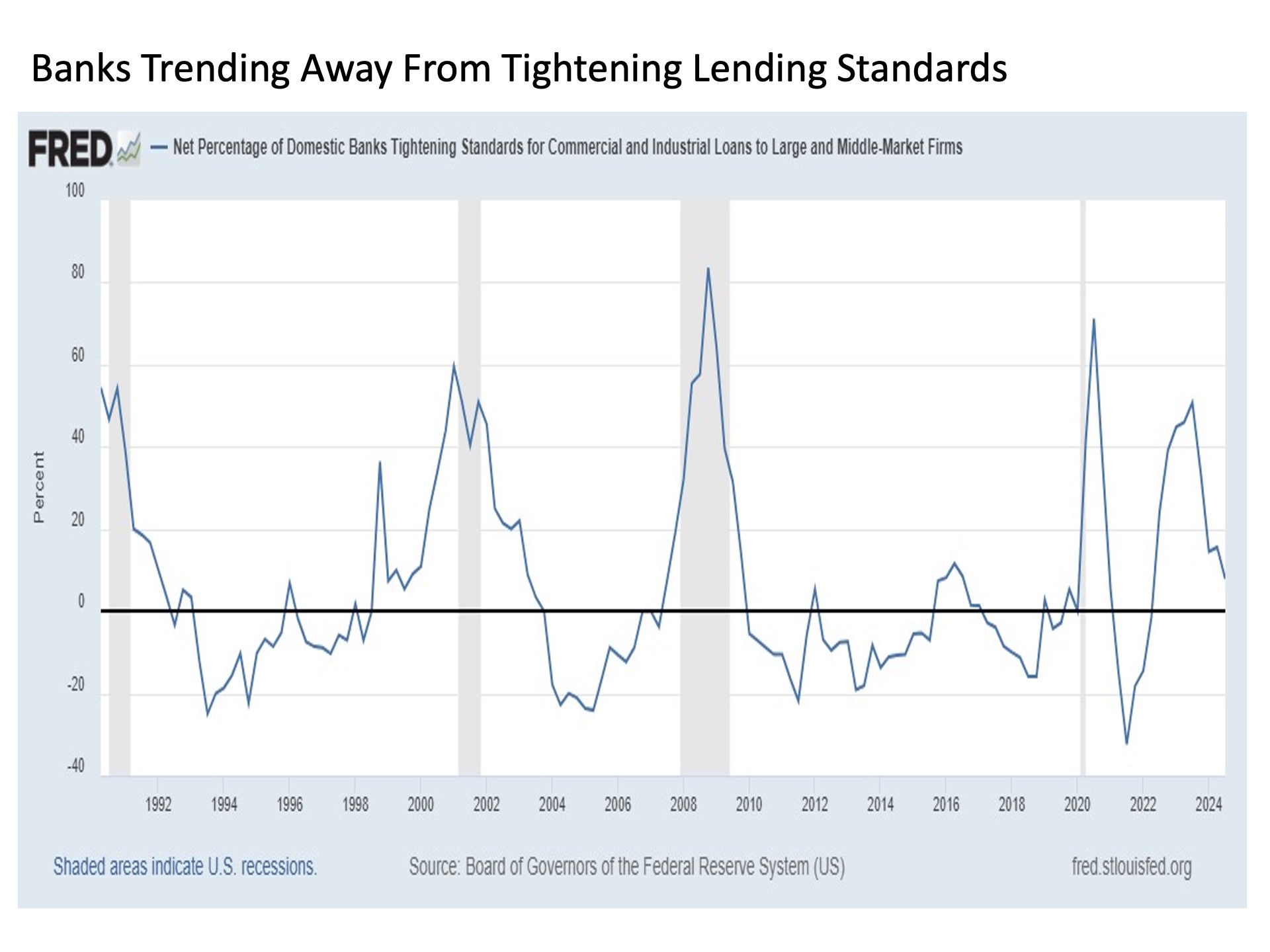

Bank tightening. Another potential downside risk for markets in the second half of the year would be a sudden tightening of bank lending standards for any number of reasons. For example, a risk that continues to overhang lending markets over the last couple of years has been chronic problems in the commercial real estate sector. These challenges have largely simmered without feedthrough effects to the broader financial system, but as this problem lingers the risk remains that issues reach a threshold where banks are forced to rein in lending activity more than they already are.

Geopolitical risk. History has repeatedly reminded us that the global community remains an unpredictable place. This includes unpredictable military and/or terrorist events that can arise suddenly and often unpredictably. While capital markets have a long history of quickly rebounding following the shock of a political event (the fact that the U.S. stock market was trading higher in December 2001 versus its pre-9/11 levels is just one example), each event will need to be evaluated for its associated financial system impacts as they arise.

What about the election? While the upcoming election in November is likely to garner a lot of conversation about the associated impact on financial markets, history has provided us with a few key conclusions that are worth keeping in mind as we draw closer to election day.

First, election years have historically been positive for financial markets. Why? Because one of the primary goals of a politician is to get re-elected. And one of the best ways for a politician to get re-elected is to make sure their voters are happy. And one of the best ways to make your voters happy is to spend money (fiscal policy) on the things they care about. And when politicians spend money, it is stimulative to the financial system.

Second, the stock market has historically performed well in the weeks that immediately follow election day. This has been true regardless of what candidates or which party wins the election. Why? Because the one thing that investment markets hate more than anything else is uncertainty. And once the election is over, the uncertainty of which candidates and which parties will be in control of the executive and legislative branches has been eliminated (hopefully). Once markets know who their politicians are going to be that will be in charge of setting fiscal policy, they can more accurately adjust their investment models and have more confidence in allocating capital to the markets.

Bottom line. With a great start of the year already under our belts, we still have good reason for optimism about further gains as we enter the second half of the year. Risks remain, however, so we should not be surprised if the markets pull back for any number of reasons along the way.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 597032-1