The summer season is now officially underway. And despite robust gains already this year, capital markets are primed and ready for a hot stock summer.

Hot. U.S. stocks are off to a hot start this year. In what would be considered a strong year by most standards, the S&P 500 is already higher by nearly +12% in 2024, and it’s not even June yet. With such strong gains already in the books, it might be reasonable to think that stocks are overdue to cool off a bit. But as the summer temperatures heat up, there’s good reason to think that U.S. stocks may follow suit. The following are a few reasons why.

Fundamentals. U.S. stocks are indeed expensive from a historical perspective. For example, the S&P 500 is trading at nearly 28 times earnings, which is more than 75% above its long-term historical average. Valuations do matter in the long-term, but history has shown that they often can be overlooked for an extended period of time in the short-term as long as economic growth is strong (check), corporate earnings growth is robust (check), and the underlying market liquidity environment remains abundant (check). Valuations will matter again someday, but in a presidential election year where the fiscal policy environment is likely to remain as supportive as monetary policy, it’s not likely to matter this summer.

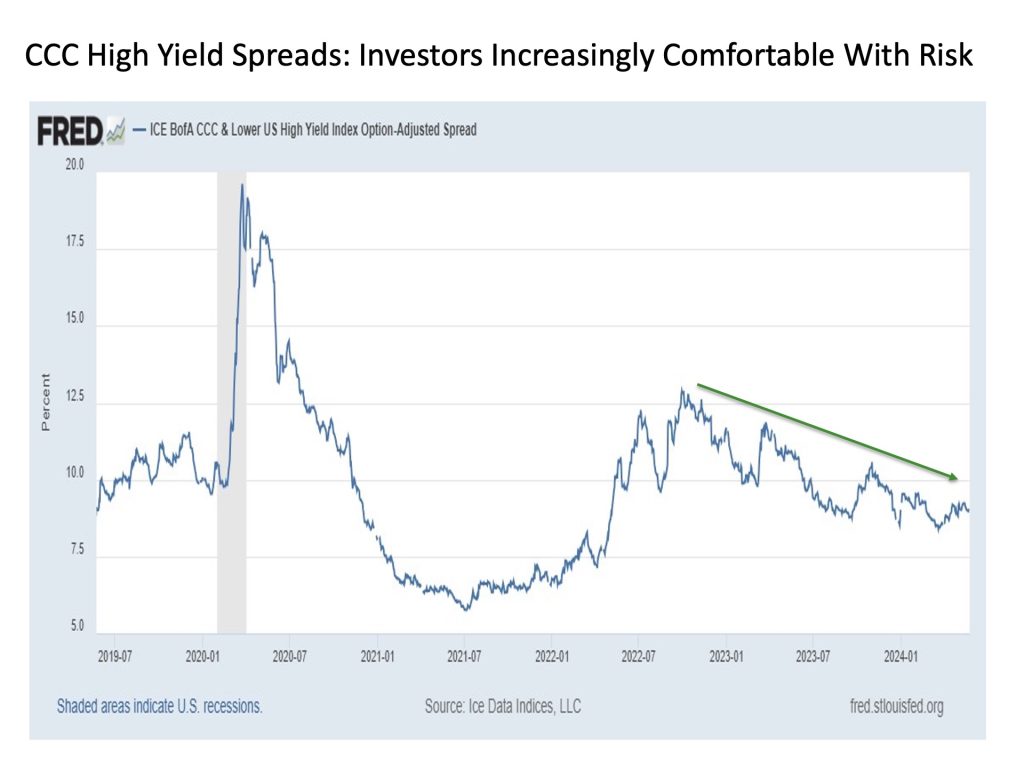

Risk appetite. A variety of indicators suggest that investor risk appetites remain alive and well. Among the many indicators supporting this notion is CCC and lower rated corporate bond spreads over comparably dated U.S. Treasuries, which is shown in the chart below.

When this spread is rising like it was during COVID and heading into the inflation outbreak of 2021-22, this indicates that investors are fleeing risk, which is not good for low quality corporate bonds and is subsequently not good for stocks. Conversely, when this spread is falling like it has been steadily since 2022, it means that investors are increasingly eager to take on risk. As long as this spread continues to trend lower through the summer, this is supportive of higher stock prices.

Inflation in check. Despite all of the fuss about stronger than expected inflation readings throughout the early months of 2024, U.S. stock prices have shaken off these concerns in marching higher. So if the recent development of cooler than expected inflation starts to become a trend into the summer, this could unleash U.S. stock prices even more. And if inflation expectations are any sign, the long-term odds favor more disinflation going forward over a renewed rise in inflation.

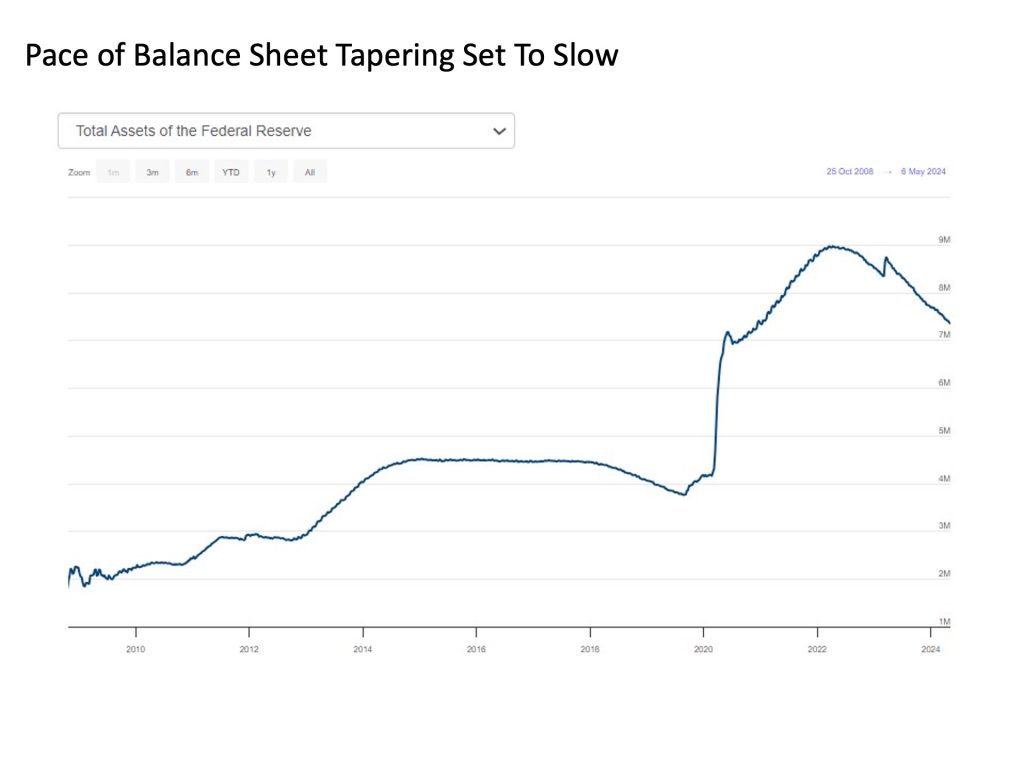

Refreshing liquidity. Amid widespread signs of already abundant liquidity, the U.S. Federal Reserve is set to give the market an added boost as the summer gets underway. The Fed has already lopped more than $1.2 trillion in total assets from its balance sheet since 2022 (nearly $9 trillion to $7.8 trillion), and U.S. stocks have hardly noticed. And starting in June, the Fed will slow the pace of its balance sheet reduction from $95 billion to $60 billion per month. The reduction will come from scaling back the roll off in U.S. Treasuries from maturities not being replaced from $60 billion to $25 billion per month.

Yes, the U.S. Federal Reserve is still draining liquidity on net even after this tapering reduction. But impacts from changes in monetary policy are not only absolute but also relative. In other words, if the U.S. Federal Reserve is scaling back their Treasury roll off from $60 billion to $25 billion, this means the Fed will soon be buying $35 billion more in U.S. Treasuries than they have been previously. This means that the U.S. financial system starting in June will have an extra $35 billion per month sloshing around than it had before. And as the time since the Great Financial Crisis has repeatedly taught us, more liquidity has an uncanny way of finding its way into the U.S. stock market before it’s all said and done.

Bottom line. U.S. stocks have had a great year so far. And a variety of indicators suggest that despite these strong gains already that we have good reason to anticipate a hot stock summer in the months ahead.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 584576-1