The latest jobs report for the month of January came in “hot”. The latest reading on CPI inflation to start the New Year was “hot”. While most of us are all for some unexpected heat during the frigid winter months, these hot readings on the U.S. economy have upset the thesis for many investors banking their portfolio strategies on a steady wave of interest rate cuts from the U.S. Federal Reserve in 2024. But maybe these recently hot economic readings are signaling an outcome even better for investors in the year ahead.

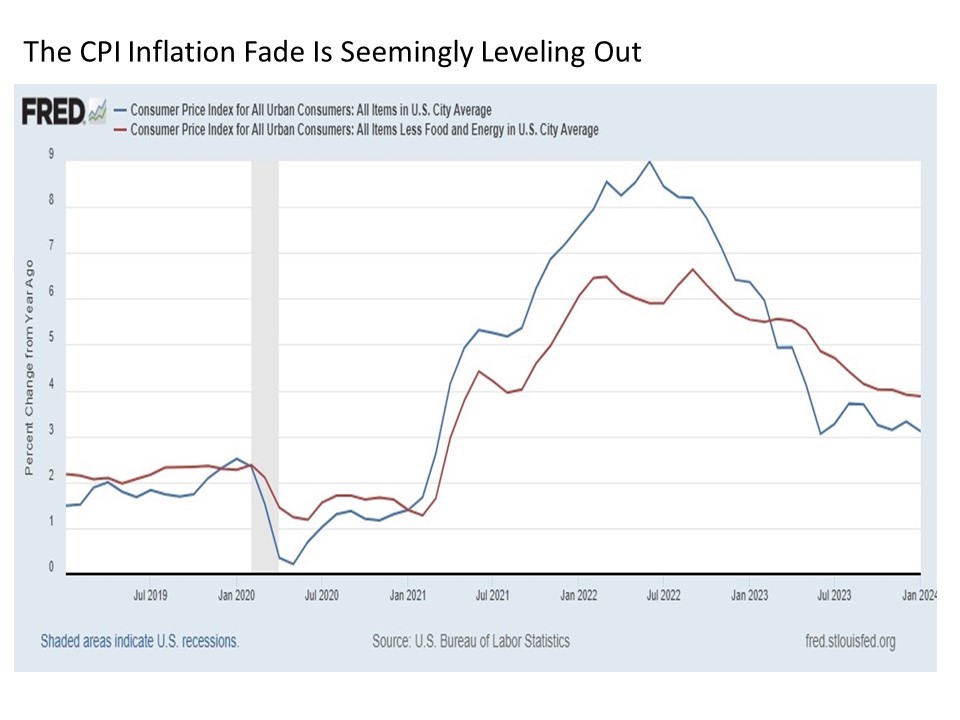

The heat is on. As cold snow blanketed the northeast U.S. this Tuesday, the Bureau of Labor Statistics issued its latest “hot” release on monthly inflation for January. While the headline annual inflation rate based on the Consumer Price Index (CPI) fell marginally from 3.32% in December to 3.11% in January, it was expected to drop further. Moreover, the headline annual inflation rate for last month is still higher from where it bottomed at 3.05% last June.

Looking under the surface, the annual core inflation rate on the CPI that excludes the more volatile food and energy components also fell, but just barely. Consider the last four Core CPI readings dating back to October 2023: 4.02%, 4.02%, 3.91%, 3.87%. That’s 0.15 percentage points of core inflation decline in four months.

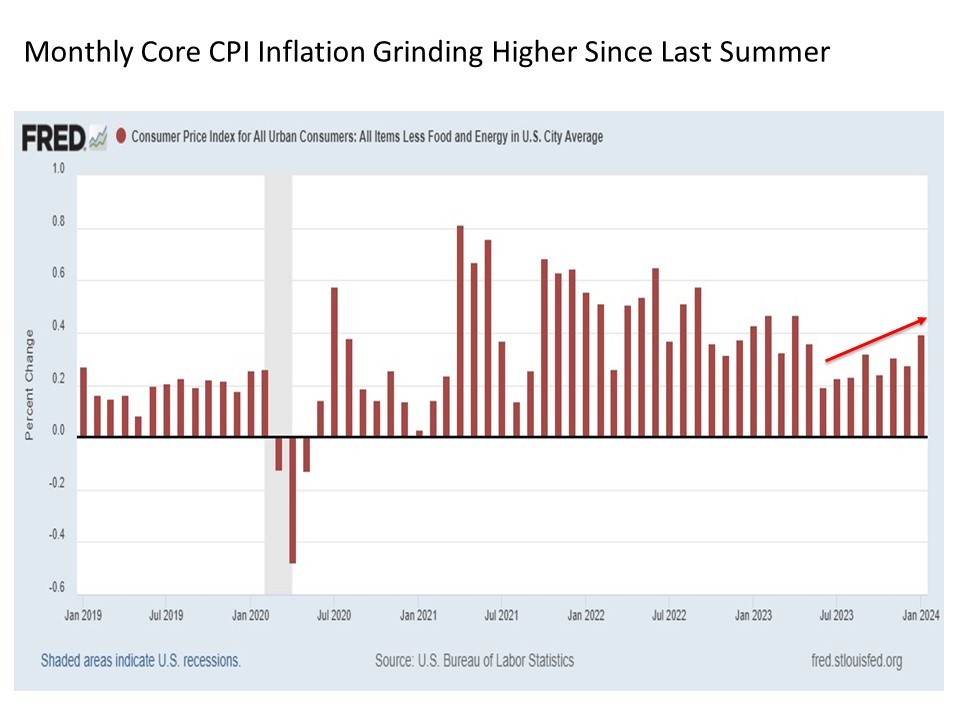

The monthly percentage change in the Core CPI adds to inflation concerns, as this reading has been trending gradually higher since last summer, with the latest reading in January setting a new peak last seen nearly a year ago.

All of this is sending signals that the fade in inflation since its 2022 peaks may be increasingly leveling out. And for a U.S. Federal Reserve whose mandate is in part to ensure “price stability” (read: keep inflation under control), this leveling of inflation at still relatively high levels (remember the Fed’s 2% inflation target) threatens to put the kibosh on investor hopes for a wave of Fed rate cuts this year.

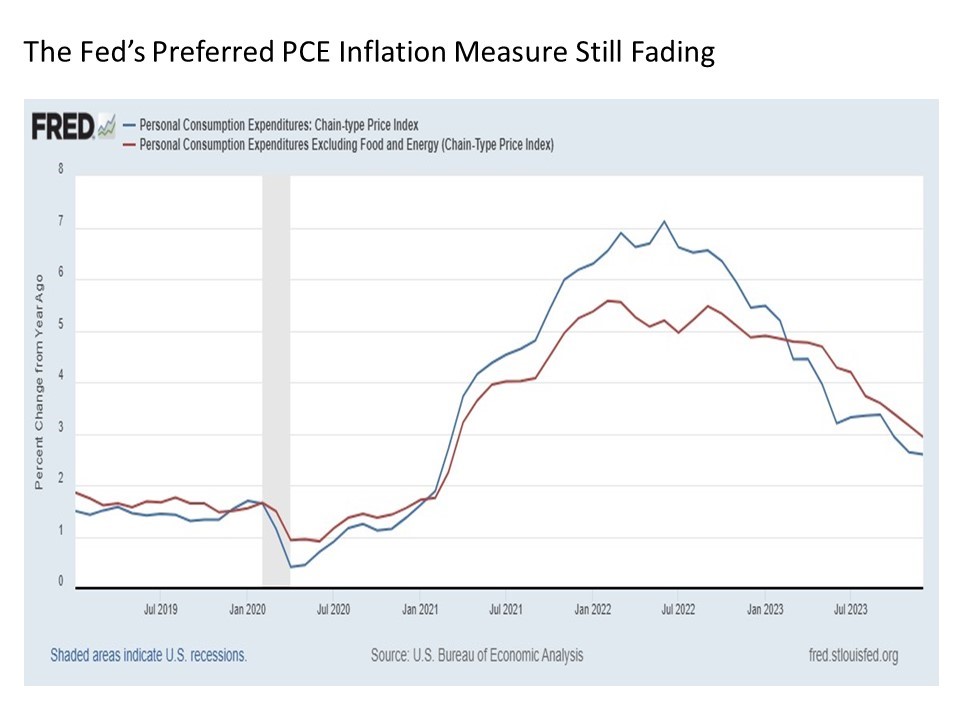

Adjusting the temperature. Before we get too caught up in the recent inflation readings, it is important to take a broader view. The first important point to remember is that when monitoring inflation, the Fed has a different preferred inflation measure. Instead of relying on the Consumer Price Index, the Fed focuses on the inflation readings from the Personal Consumption Expenditures Chain Price indices. And on these readings, the news on inflation is much more reassuring.

While we won’t have the latest reading for January for a couple of weeks, the trend in the headline and core PCE price indices remain more definitely lower. In addition, these readings are considerably better on an absolute basis at 2.60% on headline annual PCE inflation and 2.93% on Core PCE inflation. These are much closer to the Fed’s 2% target rate.

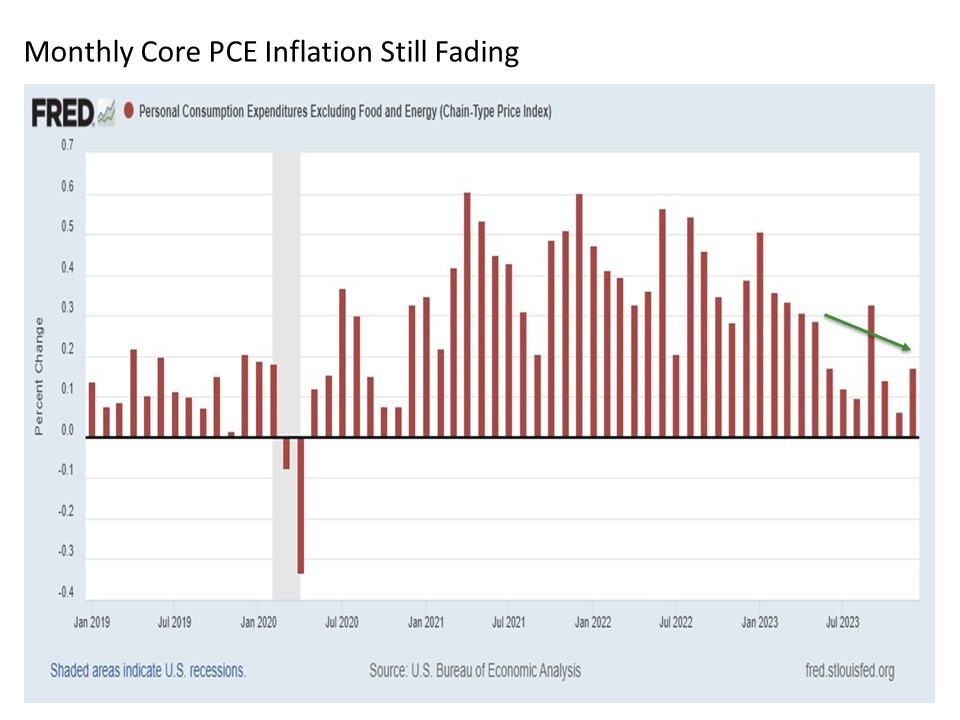

Taking a look at the month’s Core PCE inflation data, we see that, unlike its Core CPI counterpart, these readings have been choppy at worst and continue to trend lower if anything.

This raises an important point. As investors, we should be measured in reading too much into one specific economic data release and even one particular economic measure. The U.S. economy is massive, and measuring its various underlying forces is highly complex. Thus, considering a variety of readings, including those that may be directly related to the same concept, is a worthwhile exercise over time.

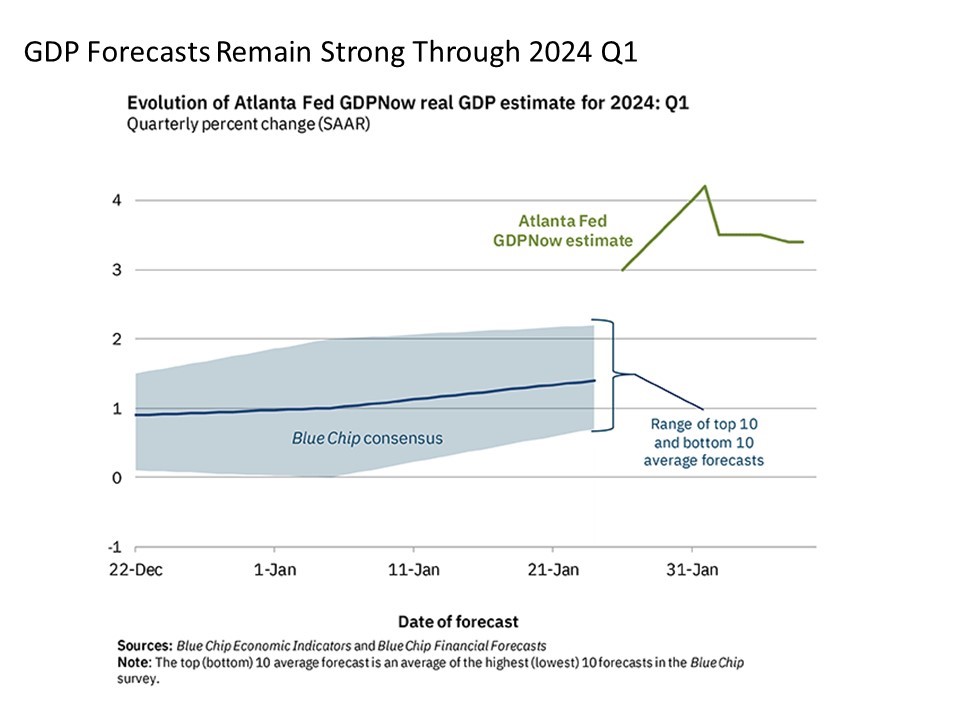

Feel the heat. Nonetheless, it still cannot be denied that the U.S. economy is still running hotter than expected as we move our way through 2024. Many investors were anticipating a slowing of the U.S. economy this year with the possibility of a mild recession unfolding along the way. Instead, we’ve already seen the U.S. economy post a Real GDP growth rate of 3.3% in 2023 Q4 which was much stronger than expected, and current forecasts for 2024 Q1 are for another quarter of strong 3.4% growth according to the Atlanta Fed GDPNow forecast. Economists have been slowly catching up with these projections, just as they did in previous quarters through the second half of 2023.

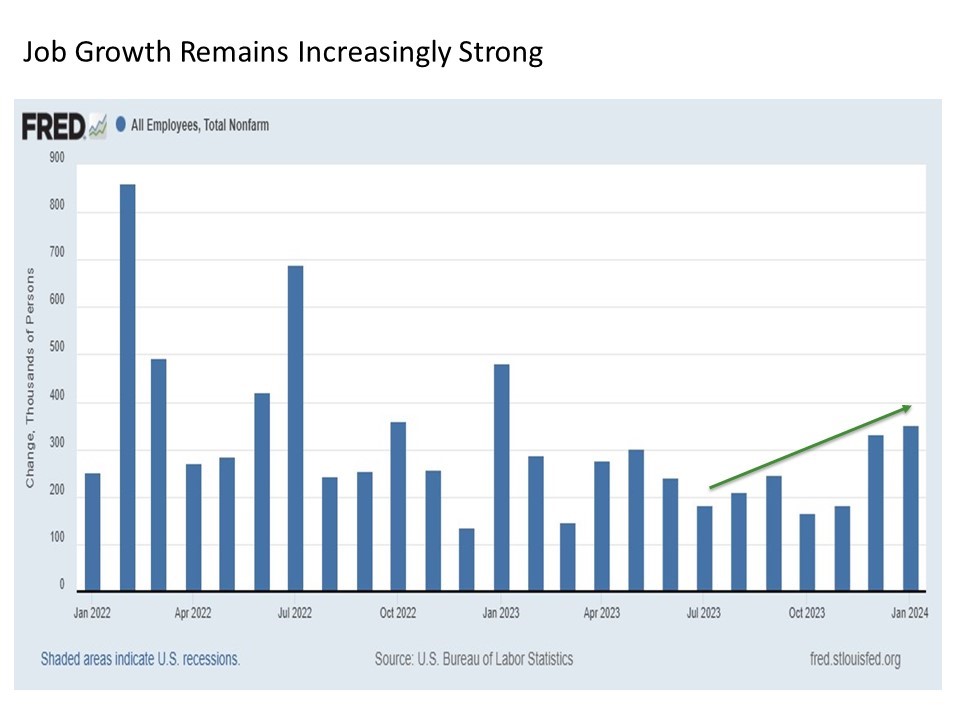

Trends in the employment data are backing up these signals of persistent economic strength. While job growth has been expected to slow as we headed into 2024, we’ve seen the monthly change in total employment in the U.S. steadily accelerate since last summer including the latest reading for January when a strong 353,000 new jobs were estimated to be added to the U.S. economy.

Better than expected economic growth. Stronger than expected new job creation. Inflation readings that are still above target and may be coming down at a slower rate. None of these are the makings of a Federal Reserve that is rushing to cut interest rates. Yes, the real Fed funds rate is at its highest levels since before the Great Financial Crisis (GFC), but maybe it needs to remain this high to maintain “pricing stability” in check in an economy that is already promoting “maximum employment”.

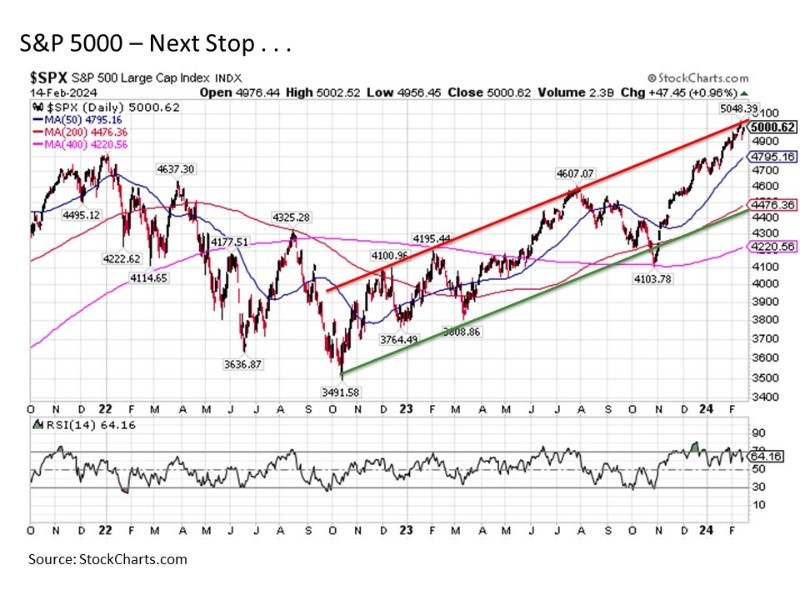

Some like it hot. All of this brings us to an important point to increasingly consider as we continue through 2024. Despite all of these unexpectedly hot economic readings and being overdue for at least a short-term correction, the U.S. stock market as measured by the S&P 500 continues to hover at the high end of its trading range since the October 2022 lows, crossing over 5000 for the first time in its history in recent days. And it may be persisting in setting new highs in 2024 for good reason despite the fading hopes for a wave of liquidity injecting Fed rate cuts this year.

Investors have already pared back their expectations for Fed rate cuts in 2024. At the start of the year, the market was pricing in as many as six quarter point Fed rate cuts by the end of the year. Today, this has been lowered to four rate cuts. This Chief Market Strategist would suggest that this forecast is still too ambitious, as two to three quarter point Fed rate cuts may be the most we might reasonably expect this year. And we might not see any rate cuts at all in 2024, but if we do, this could be a very good thing for investors and the markets at the end of the day.

Investors have been conditioned for more than a decade since the Great Financial Crisis for higher stock prices on the back of liquidity injections from interest rate cuts and quantitative easing from the U.S. Federal Reserve. Understandably, this dependence on “bad news is good news” is a hard habit to break. But we can also remember the times before the GFC when stocks would move sustainably higher regardless of the U.S. Federal Reserve, as it was advancing based on the sound and healthy fundamentals of strong and steady economic growth in a normally functioning interest rate environment “good news is good news”). Such are the conditions that appear to be increasingly taking form as we move through 2024.

So while it has been a long time now, it is very possible that a key silver lining for financial markets and the economy associated with the COVID crisis and the massive inflation inducing monetary and fiscal policy response started under the Trump administration and continued under the Biden administration is that may have finally broken the sluggish economic growth and disinflationary fever that plagued us for so long in the post GFC period. In short, we may have finally returned to normally functioning financial markets, as this would be a resoundingly good thing as we continue through the remainder of the decade. Only time will tell, but this Chief Market Strategist continues to like it hot.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 542275-1