We’ve had a busy week in the markets this week between a crash in the crypto market with the fall of FTX, the midterm elections, and new inflation data. And this morning we will hear on consumer sentiment from the University of Michigan. With all the action this week and with all the ups and downs, it’s only fitting there has been a full moon out there! But as long-term investors, we maintain our resolve and look ahead to better days “In Due Time”.

There were some key moments this week, but by far, the inflation report on Thursday set the market off to one of those full moons we’ve been seeing in the skies this week. The market rallied big with the Dow up 1,100 points (+3.4%), the S&P 500 up almost 200 (+5%), and the Nasdaq up almost 700 (+6.7%). Clearly not one of those normal days but obviously a welcome relief to all the volatility we have been seeing all year. The question is will inflation continue to come down and will the market like it? It seems so from yesterday’s action but make no mistake we are nowhere near out of the woods yet on inflation and the Fed still has work to do. Case in point check out the shelter component which again rose last month by +0.8%. This is the #1 contributor to CPI so if it’s going to come down then shelter has to come down first. Supply chain also has to work itself out which we are still seeing challenges there. But it was interesting to see the typical volatile energy sector was pretty steady this month after being down a combined 11.3% in the prior 3 months. Which makes sense as gas prices have been steady to up lately. But overall it was nice to at least see the “core” prices moderating (ex-food and energy). This could be a plus as the Fed evaluates what to do next as we head into 2023.

That being said, don’t forget what Powell said back in September (see bottom of page 10) when he inferred another +125 bps of rate hikes to close out 2022. So now that we already had +75 last week, that means they may raise by 50 in December. And maybe at that point and with Thursday’s print, combined with supply chain improvements which we should have a better read on through the holiday season, they may announce a pause to start 2023. Which would obviously be very well received by the market.

In other economic news, we saw jobless claims come out on Thursday as well, which rose by 7,000 last week to 225,000. Continuing claims rose 6,000 to 1.493 million. These figures are still very low by historical standards which is basically telling us we still have a strong labor market. Which the Fed is trying to cool down. This is the challenge the Fed has as they try to navigate a potential soft landing.

In politics, counting continues but it’s looking like DC may be in gridlock for the next two years. Meaning a Democrat for President and a Republican controlled House and/or Senate. That’s good for the markets and if history stands then we might see a nice post midterm rally as data suggests the market returns on average +16.3% in the 12 months following midterms dating all the way back to 1962.

Mega cap tech and chip stocks also bounced very nicely this week which could be a sign of a potential “steady state” in valuations as we head into 2023 when rate hikes subside. It also shows the entire tech sector has been oversold this year. We still hold a reasonable exposure to these companies as we consider them to be “tech infrastructure” type core holdings and not necessarily “growth vs value” holdings. Meaning they have shifted their models to serve the needs of the future in terms of communication, security, and storage.

Looking ahead, we should expect the economy to continue to slow but eventually we should also expect a Fed pause and when that happens it should be well received by the markets. This will happen “In Due Time” which as long-term investors is our mantra. But at the same time, we should be prepared to ride out the storm which is why we still maintain a defensive, tactical, and quality theme in all GVA Asset Management models that we manage here in-house. For example, we added to some healthcare companies on our last round of trades to maintain that defensive posture.

Thanks for reading and have a nice weekend!

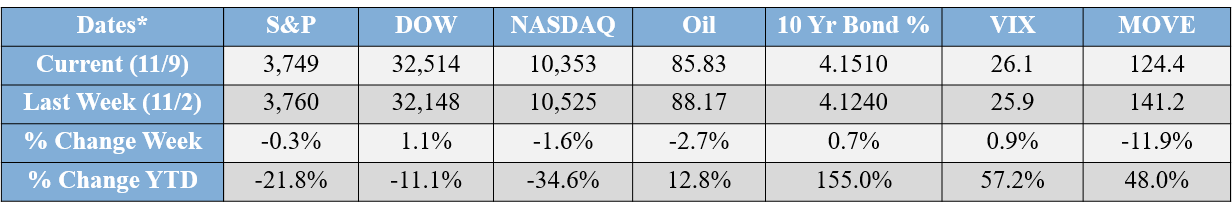

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking#: 1-05346398